are donations to campaigns tax deductible

Its only natural to wonder if donations to a political campaign are tax deductible too. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

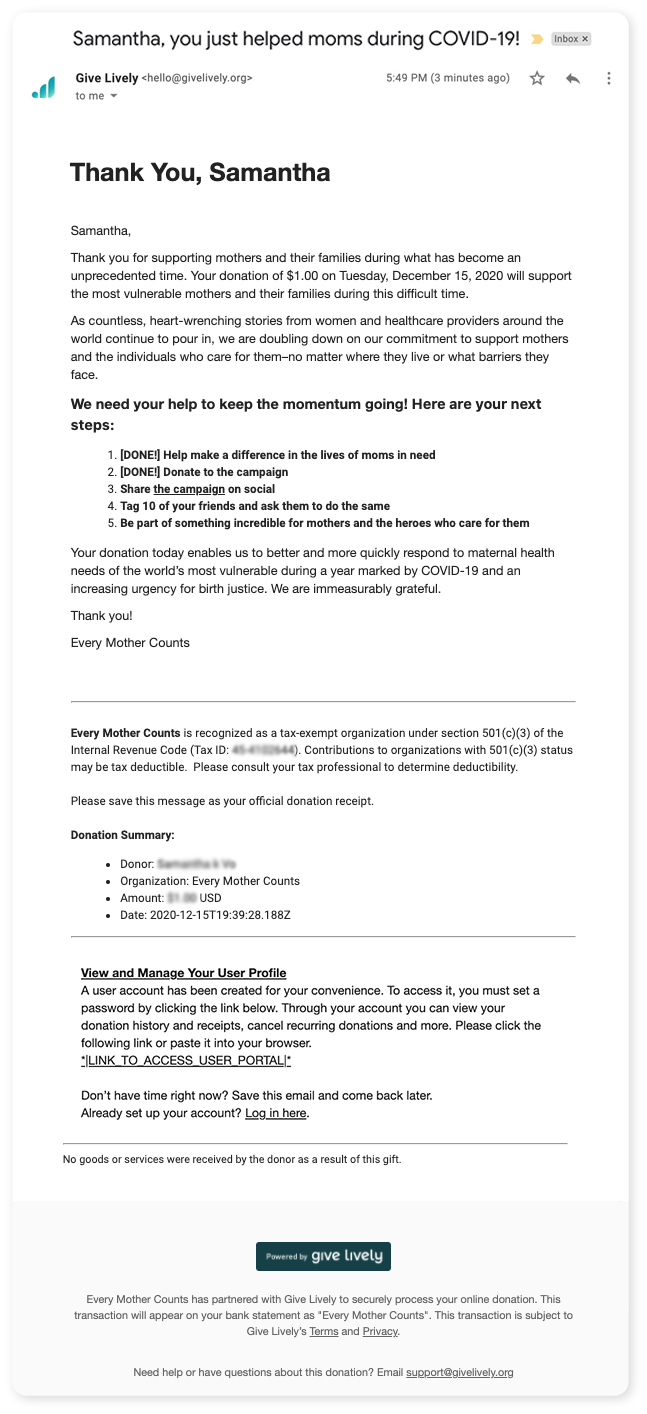

Give Lively Faq Are Donations Made Through Give Lively Tax Deductible

Simply put political contributions are not tax deductible.

. The same goes for campaign contributions. The answer is no donations to political candidates are not tax deductible on your personal or business tax return. Furthemore the same goes for campaign.

For deductible values of single items exceeding 5000 complete Section B and perform an official. Political parties Political committees Individual. That includes donations to.

Likewise gifts and contributions to 501 c. Contributions or donations that benefit a political candidate party or cause are not tax deductible. Brief On Donations To Political Campaigns Not Being Tax-Deductible Any payment contributions or donations to political groups or campaigns are not tax-deductible.

Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. Even though donations to political campaigns are not tax deductible or eligible for a tax deduction there are still limits placed on the amount of money that people can give to. Americans are encouraged to donate to political campaigns political parties and other groups that influence the political landscape.

Note that donations to campaigns run by individuals are generally not tax deductible. 5000 There is no limit on contributions to Super PACs To a state local or district party. To a standard PAC.

36500 However the IRS. Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person.

Hence the answer is no contributions to political candidates are not tax-deductible on your personal or business tax return. Fill out Section A if your tax-deductible value is between 500 to 5000. Donations of property are too.

These charitable contributions that are made to your church cannot be more than 50 of your adjusted gross income your AGI Your charitable as well as all of your tax. Monetary donations to qualified organizationswhether by cash check credit card or payment appare tax-deductible. United Kingdom In the UK charitable giving works differently and the charity receives the benefit not.

On the part of the. Donations to this entity are not tax deductible. If the campaign youre donating to is created by a registered nonprofit organization or is raising money for a specific charitable purpose then your donation may be.

10000 combined To a national party. The answer is no political contributions are not tax deductible.

Download Tax Deductible Donations

Clay Smith M D Man Woman Of The Year Campaign

Converting Twitter Posts Into Campaign Donations First Draft Political News Now The New York Times

Giving Campaign 2nd Century Invictus Fund

Can You Deduct Political Campaign Contributions From Taxes Money

Support The Amf Airmen Memorial Foundation

Are Campaign Contributions Tax Deductible

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible

A Cause That S Important To Our Community Woodbridge Nj Patch

Are Charitable Contributions Tax Deductible Taking Care Of Business

Why Political Contributions Are Not Tax Deductible

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Are Political Contributions Tax Deductible Smartasset

Why Political Contributions Are Not Tax Deductible